MYBUCKS BANKING CORPORATION MALAWI

NFB launched operations in 2015, and has since established itself as a strong niche corporate banking business. NFB has six branches in Malawi, 11 ATMs and 96 employees. By 31 May 2017, the business had grown its assets to EUR14.4 million (inclusive of a net loan book of EUR 4.3 million), hosting a deposit base of EUR8.2 million and a post-transaction equity base of EUR5.7 million.

This transaction will also see GetBucks Malawi disposing its assets and liabilities to the new coowned business, with the enlarged asset base of NFB totalling EUR22.1 million (including a net loan book of EUR8.4 million). Effectively, the transaction will come in at a P/B of c. 2.0x –comparing favourably to peers in the region.Tim Nuy, Deputy CEO, MyBucks said: “The combination of NFB’s traditional banking expertise with MyBucks’ proprietary technology will position NFB as a strong digital bank within Malawi. This is in line with our long – term strategy to become a truly digital bank in all the markets where we operate.

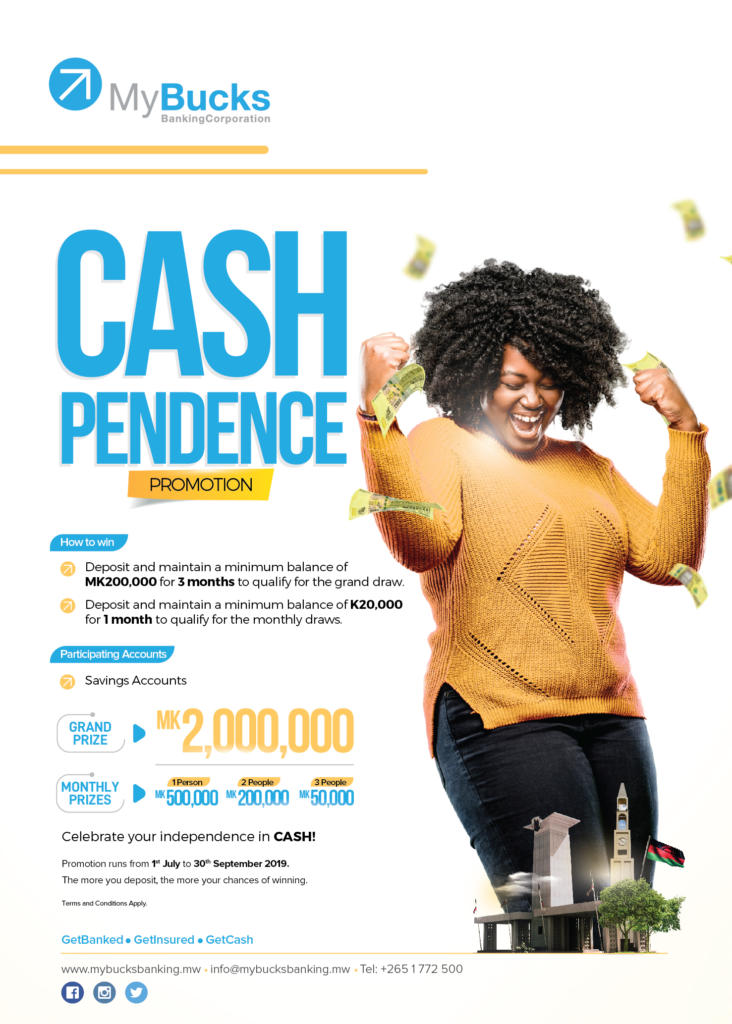

Through a deposit gathering strategy, we look forward tosubstantially reducing our cost of funding and enhance

profitability for the Group.”Dr Rajan Mahtani, Chairman, Finsbury Investments Limited and 50% shareholder in NFB said: “We areexcited about the efficiencies that MyBucks will bring to NFB

Features

Not any Videos.